A Commenter's Comment

In response to one of my posts on the Fair Tax, Frank posted the following:

The FairTax would create a universal, explicit, and large tax penalty on those unable to buy homes. It would redistribute many billions of dollars upward from renters to homeowners. While homeownership would increase - rational renters will scramble to buy homes under this tax - it will also create a permanent underclass of those unable to buy homes who will pay a steep tax penalty for the privilege of renting the roof over their head. The FairTax would create Two Americas.

Of course, I disagree with Frank and found this on the Fair Tax website, It's a direct copy and paste - I didn't want to have mistakes on my part and I did eliminate portions that did not pertain to real estate and housing (it's a little long, so please bear with me). All emphasis is mine:

The FairTax booms home ownership:

Simple math shows a 71-percent reduction in a homeowner’s mortgage costs. Harvey Abernethy, Realtor®

The FairTax plan is an integrated proposal with many positive features, not the least of which are the advantages that will accrue to residential real estate ownership.

• Pay your entire house payment, both principal and interest, with “pre-tax” dollars.

• Get this benefit without itemizing deductions, which only a small percentage of homeowners do today.

• Save for down payments much faster, without the penalty of taxation.

• Reduce interest rates even lower than they are today.

A FairTax rate of 23 percent, calculated as our current federal tax rates are calculated, would produce the same amount of revenue to the federal government as all the various forms of income and payroll taxes now collected from the productive incomes of individual Americans and American businesses. This fully funds Social Security and Medicare and all other government services at the current funding levels.

Interest rates come down – more.

The FairTax reduces interest rates by approximately two percentage points, the current difference between tax-exempt mortgages and taxable home mortgages, since the interest income on a home mortgage is currently taxed to the lender of the money. A home mortgage that today could be obtained for an interest rate of approximately 6.75% could be re-financed with a new mortgage at a 4.75% interest rate.

The FairTax booms home ownership.

The FairTax proposal honestly detaxes low-wage workers.

Today’s income taxes and tomorrow’s FairTax for Mr. and Mrs. Fair. As an example, Mr. and Mrs. Fair are married, both self-employed, with two children. Their home has a $150,000 mortgage payable over 30 years at 6.75%. When the FairTax becomes law, they can refinance for 4.75%. Mr. Fair is paid on commission as a manufacturer’s representative, and this year made $28,000 after business expenses. Mrs. Fair runs her eBay business from home and made $29,000 after business expenses. They jointly set aside $2,000 in their IRA account. They are the lucky taxpayers because they are two of only 27 percent of all Americans who actually qualify to itemize their income tax deductions. They have calculated their itemized deductions to be $11,637, most of it from their home mortgage interest deduction.

Like all Americans, the only thing that really matters to them is what is left over after taxes to have as their spendable income. Simple math tells the truth. Their federal income tax return would show the following:

Current income / FairTax

Mr. and Mrs. Fair's spendable income analysis tax system system:

Their combined income before taxes $57,000 / $57,000

Less Mr. Fair's Social Security and Medicare taxes $4,018 / $0

Less Mrs. Fair's Social Security and Medicare taxes $4,162 / $0

Less their combined federal income taxes $3,456 / $0

Income after taxes $45,364 / $57,000

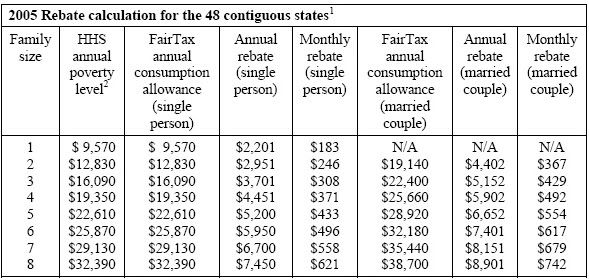

Add their universal PCA rebate $0 / $5,575

Their combined spendable income $45,364 / $62,575

Their house payment – current system,

then refinanced $11,674 /$9,390

House payment as a percent of spendable income 25.7% / 15.0%

Simple math shows us that by maintaining our current federal income tax system, Mr. and Mrs. Fair’s house payment is consuming a much larger part of their potential spendable income. When one goes from spending 15 percent to spending 25.7 percent of their spendable income, that is a 71.3-percent increase.

An immediate effect of the FairTax is a $17,211 increase in their spendable income, which is a 37.9-percent increase in the current spendable income. Consumption spending is elective spending; consumption taxing is elective taxing. Under the current federal income tax system, when Mr. and Mrs. Fair spend their spendable income for any goods or services, new or used, they pay with post-tax dollars, except, in their case, their home mortgage interest. Most homeowners do not itemize and therefore must pay their equity and interest with post-tax dollars. Additionally, in all retail purchases, they are paying the cost of the federal income tax system that is imbedded in the price of each product or service produced in America, which inflates those prices by an average 22 percent at the checkout counter. The FairTax eliminates these costs and through natural competition in the market place, prices of these goods and services fall by the amount of those reductions.

Under the Fair Tax, when they elect to spend their spendable income for new goods and services, they pay the FairTax on those purchases. If Mr. and Mrs. Fair did not save any of their income and spent it all on new goods and services, their purchasing power is as follows:

Current income / FairTax

Mr. and Mrs. Fair's purchasing power analysis tax system system:

Their combined spendable income $45,364 / $62,575

Their house payment – current system,

then refinanced $11,674 /$9,390

Spendable income after house payment $33,690 / $53,185

Average income tax costs embedded in products/services 22%

FairTax paid as part of the price of new goods/services 23%

Actual taxes either imbedded or paid as the FairTax $7,412 / $12,233

Spendable income after house payment $33,690 / $53,195

Actual taxes either imbedded or paid as the FairTax $7,412 / $12,233

Purchasing power of spendable income $26,278 / $40,952

Mr. and Mrs. Fair’s true after-tax purchasing power of their spendable income is increased by $14,674, which is a 55.8-percent increase over their current purchasing power.

This is how the FairTax benefits just one family. There are many more benefits for all Americans. This improvement in Mr. and Mrs. Fair’s personal financial situation occurs only when the FairTax becomes law. And it is merely an example of the many benefits of the FairTax that accrue to you and every other American. Please learn more by visiting www.fairtax.org. I guarantee that you will find resolution to any concern you may have. The goodness of this bill is overwhelming. This bill is not for the benefit of any special interest group. Indeed, the lives of all decent Americans are greatly improved by the changes the FairTax brings.

About Harvey Abernethy

Harvey Abernethy is a volunteer district director of FairTax.org in the 2nd congressional district of Tennessee. A graduate from the University of Tennessee with a major in real estate and urban development, he has practiced all facets of real estate as a professional for 33 years. He can be reached via email at h.abernethy@att.net or by mail at:

221 West Young High Pike,

Knoxville, Tennessee 37920.

Me again. This might not exactly address Frank's comments, but I believe that the Fair Tax will allow more people to save money toward homeownership. Interest rates will come down, allowing more people to afford mortgages. I don't believe a tax penalty would be placed on anyone more than there already is. Most people will buy pretty much the same goods that they already do, and would pay a consumption tax on why they buy, not on their income, allowing them to have that extra disposable income to save or to pay toward mortgages.

And Frank, you don't think there are already two America's? Today's "underclass" seems to be anyone who makes less than $90,000. Why did I choose $90,000 as the cut off? Anyone making more than $90K pays no more in SS taxes than the person who makes $90K. It might be an arbitrary figure on my part, but it seems as good a figure as any. I personally think that the "wealthy" are those who pay the highest taxes.

I'm not sure there aren't three America's - the lower income class, the middle class, and the upper, wealthy class. And once again, what could be more fair to everyone than everyone paying the same tax rate?