Live your life in such a way...... ....that when your feet hit the floor in the morning, Satan shudders and says...... "Oh, S**t!.... she's awake!!"

Saturday, April 08, 2006

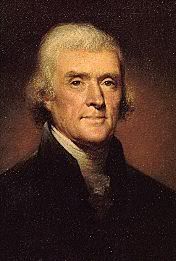

John Linder, US Representative for Georgia

The following is a comparision of the current tax code, the Flat Tax, and the FairTax. If you read the following synopsis with an open mind and do some research, I believe that any thinking person will come to realize that the FairTax is far superior to the current tax code. Is it perfect? Of course not, nothing devised by man could possibly be perfect and of course the FairTax is man-made.

If I had a choice only between the current tax code and the Flat Tax, I would want the Flat Tax. Did you know that the current tax code started out in 1913 as a Flat Tax? Ninety-three years later it has evolved into a convoluted mess that few people understand.

I've attempted to highlight the gist of the comparison, although Congressman Linder has already boiled it down to the nitty-gritty, as my mother would have said.

16th Amendment

*Current Income Tax: No Change.

*Flat Tax: No Change.

*FairTax: Proposes repeal.

*Current Income Tax: Very complex. 20,000 pages of regulations. IRS incorrect over half of the time.

*Flat Tax: Witholding continues. Individuals and businesses must still track income and file income tax forms.

*FairTax: Individuals do not file. Businesses need only to deal with sales tax returns.

Congressional Action

*Current Income Tax: Used by lobbyists and the wealthy for tax breaks and loopholes. Used by bureaucrats for social engineering.

*Flat Tax: Has some problems, but is far superior to current law.

*FairTax: 23% Linder/Peterson FairTax Act (H.R. 25). Employees receive 100% of pay. Social Security and Medicare funded from consumption tax revenue, not your paycheck.

Cost of Filing

*Current Income Tax: $225 billion in annual compliance costs.

*Flat Tax: Significant simplification costs are somewhat reduced.

*FairTax: No personal forms are filed. Significant cost savings.

Economy

*Current Income Tax: Taxes savings, labor, investment, and productivity multiple times.

*Flat Tax: Imposes a tax burden some of which is still hidden in the price of goods and services.

*FairTax: Un-taxes wages, savings, and investment. Increases productivity. Produces significant economic growth.

Equality

*Current Income Tax: The current tax code violates the principle of equality. Special rates for special circumstances violate the original Constitution and are unfair.

*Flat Tax: A flat tax is an improvement of the current income tax, but it is still open to manipulation by special interests.

*FairTax: Taxpayers pay the same rate and control their liability. Tax paid depends on life style. All taxes are rebated on spending up to the poverty level.

Foreign Companies

*Current Income Tax: Current tax code places unfair tax burden on U.S. exports and fails to neutralize tax advantages for imports.

*Flat Tax: A flat tax taxes exported goods and does not tax foreign imports to the U.S., creating unfair competition for U.S. manufacturers and businesses.

*FairTax: Foreign companies are forced to compete on even terms with U.S. companies for the first time in over 80 years.

Government Intrusion

*Current Income Tax: Current tax code requires massive files, dossiers, audits, and collection activities.

*Flat Tax: A flat tax still requires personal files, dossiers, audits, and collection activities.

*FairTax: As the Founding Fathers intended, the FairTax does not directly tax individuals.

History

*Current Income Tax: The 1913 income tax has evolved into an antiquated, unenforceable morass, with annual tax returns long enough to circle Earth 28 times.

*Flat Tax: A flat tax just won't stay flat. Starting out nearly flat in 1913, the income tax grew out of control with top rates over 90% until the Kennedy administration.

*FairTax: 45 states now use a retail sales tax.

Interest Rates

*Current Income Tax: Pushes rates up. Biased against savings and investment.

*Flat Tax: Reduces rates 25-35 percent. Neutral toward savings and investment.

*FairTax: Reduces rates by an estimated 25-35 percent. Savings and investment increase.

Investment

*Current Income Tax: Biased against savings and investment.

*Flat Tax: Neutral toward savings and investment.

*FairTax: Increases investment by U.S. citizens, attracts foreign investment.

IRS

*Current Income Tax: Retained.

*Flat Tax: Retained with reduced role.

*FairTax: Abolished.

Jobs

*Current Income Tax: Hurts U.S. companies and decreases available jobs. Payroll tax a direct tax on labor.

*Flat Tax: Positive impact on jobs. Does not repeal payroll tax on jobs.

*FairTax: Makes U.S. manufacturers more competitive against overseas companies. Escalates creation of jobs by attracting foreign investment and reducing tax bias against savings and investment.

Man-hours Required for Compliance

*Current Income Tax: Over 5.4 billion hours per year.

*Flat Tax: Reduced.

*FairTax: Zero hours for individuals. Greatly reduced hours for businesses.

Non-filers

*Current Income Tax: High tax rates, unfairness and high complexity harm compliance

*Flat Tax: Reduced tax rates and improved simplicity will improve compliance.

*FairTax: Reduced tax rates and fewer filers will increase compliance.

Personal and Corporate Income Taxes

*Current Income Tax: Retained.

*Flat Tax: Retained in a different form.

*FairTax: Both are abolished.

Productivity

*Current Income Tax: Inhibits productivity.

*Flat Tax: Increases.

*FairTax: Increases.

Savings

*Current Income Tax: Decreases savings.

*Flat Tax: Increases savings.

*FairTax: Increases savings.

Visibility

*Current Income Tax: The current tax code is hidden, embedded in prices, complex, and incomprehensible. Taxes are withheld from paychecks.

*Flat Tax: The business component of the flat tax and payroll taxes are hidden and would be embedded in prices. Taxes are withheld from paychecks.

*FairTax: The FairTax is highly visible and easy to understand. No tax is withheld from paychecks.

Friday, April 07, 2006

DEMOCRATIC

You have two cows.

Your neighbor has none.

You feel guilty for being successful.

Barbra Streisand sings for you

REPUBLICAN

You have two cows.

Your neighbor has none.

So?

SOCIALIST

You have two cows.

The government takes one and gives it to your neighbor.

You form a cooperative to tell him how to manage his cow.

COMMUNIST

You have two cows.

The government seizes both and provides you with milk.

You wait in line for hours to get it.

It is expensive and sour.

Thursday, April 06, 2006

Me? I'm gonna buy some gas stock.

As a person looking down the barrel of senior citizenhood, this is a no-brainer.

When you go grocery shopping, start in the back corner of the store. The grocery store is laid out in a way to entice you to buy things that you normally wouldn't.

Wednesday, April 05, 2006

More to follow

Tuesday, April 04, 2006

It's that time of year to take our annual senior citizen test. Exercise of the brain is as important as exercise of the muscles. As we grow older, it's important to keep mentally alert. If you don't use it, you lose it!

1. What do you put in a toaster?

2. Say "silk" five times. Now spell "silk." What do cows drink?

3. If a red house is made from red bricks and a blue house is made from blue bricks and a pink house is made from pink bricks and a black house is made from black bricks, what is a green house made from?

Monday, April 03, 2006

Sunday, April 02, 2006

your picture would be on it.

If He had a wallet, your photo would be in it.

He sends you flowers every spring, and a sunrise every morning.

Whenever you want to talk, He'll listen.

He could live anywhere in the universe and He chose your heart.

Think about the Christmas gift He sent you in Bethlehem, not to mention that Friday at Calvary.

Face it--He's crazy about you.